What To Do With Your Tax Return

Introduction

Let’s take a moment to look at both sides of the equation. Is it better going to an accountant or should you organise your own taxes? What’s more worth your time and money?

Here’s What’s Trending

In the 21st century we’re finding ourselves in a world where a wealth of information can be found within our fingertips. DIY’s are becoming more popular than ever before. So why are we finding more and more taxpayers are going to an accountant instead of lodging their financials and returns themselves?

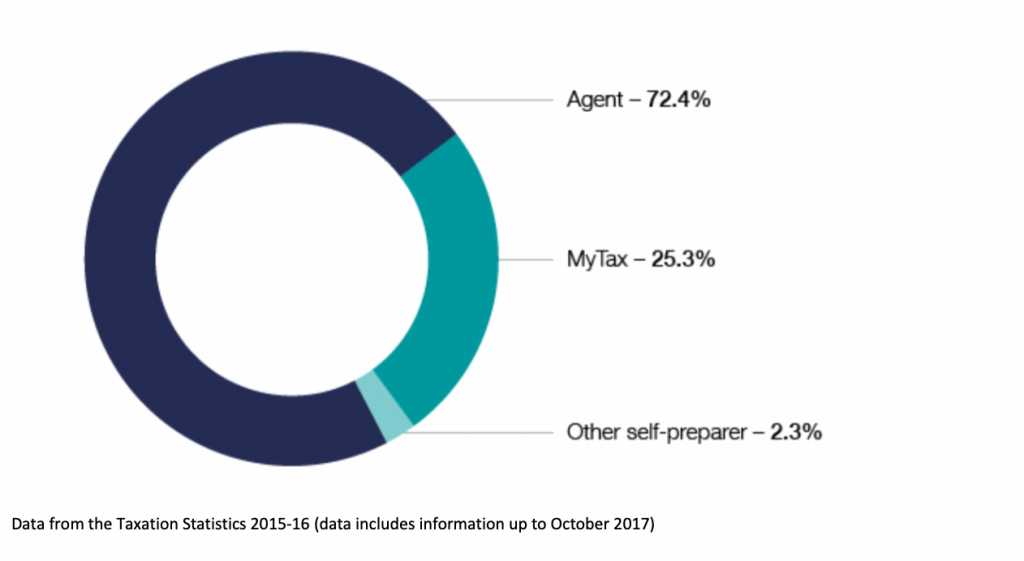

Reported data has shown that over 72% used a Tax Agent to process their tax return compared to the 25% found lodging through MyTax. The number of lodgements processed through Tax Agents is still continuing to increase.

Advantages & Disadvantages

Advantages & Disadvantages

Over the last decade we’ve seen businesses and technology grow at an incredible pace leaving us vulnerable with regular updates and changes in laws and legislation. Our daily grind and struggles also means it becomes harder to keep on tract with what’s happening with the latest tax news and updates in the economy around us. To help keep yourself ahead of the pack, find an accountant that can offer you the latest tax news and accounting updates. This will ensure you’re always a step ahead in order to run your business and taxes efficiently and effectively.

A common disadvantage found with accountants is the higher cost involved in managing tax affairs. You want to make sure you’re getting what you paid for so here’s how you do it. Find an accountant who is NOT JUST processing tax returns and financials and leaving you confused by the end of it. Find one who wants to help you achieve your financial goals but also offers a wealth of information that can be easily understood and translated back to you. Find an accountant that can understand your position and can reflect with you on a deeper level so that both, accountant and client can grow together. This in itself outweighs the cost savings of lodging financials and returns yourself, not considering the fact that accounting fees are also tax-deductible!

Taxpayers that don’t utilise accountants are more likely to lodge their return incorrectly and miss out on hundreds (or even thousands) of dollars in potential tax deductions.

If we catch on to this early, tax returns can be amended to reflect a more tax maximised outcome but racing against time is never a good place to start.

Qualifications & Recommendations

Check to see if an accountant is qualified, whether they have their Tax Agent Licence with the Tax Practitioners Board (you can search them up on www.tpb.gov.au) and watch out for their accreditations.

Some accreditations include the Certified Public Accountant (CPA). This is an easier and more common accreditation in terms of the level of study needed compared to other accreditations such as a Chartered Accountant (CA).

We recommend organising an accountant early, preparation is key. Speaking to an accountant who understands your situation and prioritises your growth is one of the essential aspects of growing your financial position. Don’t chase the cheaper accounting invoice, chase the skill and level of service!

Visit our website by clicking the logo below